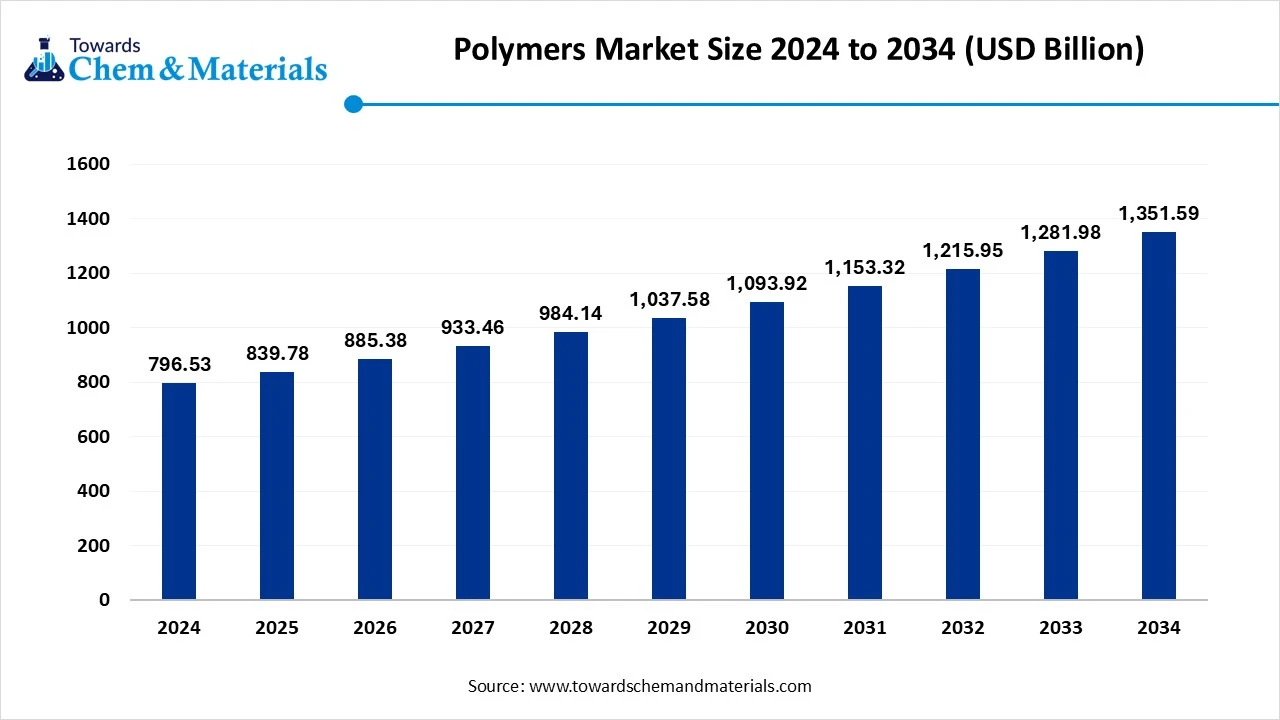

Polymers Market Size to Worth USD 1,351.59 Billion by 2034

According to Towards Chemical and Materials, the global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period from 2025 to 2034.

Ottawa, Sept. 08, 2025 (GLOBE NEWSWIRE) -- The global polymers market size is valued at USD 839.78 billion in 2025 and is anticipated to reach around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Growth in the Polymers market is being driven by rising demand in packaging, automotive, construction, and healthcare, and the use of sustainable advanced recycled materials, will ultimately propel the overall market forward with practical applications and ongoing industrial support and services throughout the world.

Download a Sample Report Here @ https://www.towardschemandmaterials.com/download-sample/5776

Polymers Market Overview

The polymers market includes the production, processing, and application of synthetic and natural macromolecules that are utilized in many sectors including; packaging and conversion, automotive, construction, and biomedical (including healthcare). Polymers have excellent versatility, light-weight properties, and chemical resistance, which are benefits that have led to their commonly used across different sectors.

Overall, the market is expanding, based on rising demand for sustainable, high-performance materials; innovative products including bio-based polymers and biodegradable polymers; and decoupling from existing manufacturing technology to new advanced manufacturing processes.

Polymers Market Highlights

- By region, Asia Pacific dominated the polymers market in 2024 with 45% of the industry share, akin to an enlarged manufacturing structure and heavy consumer needs.

- By region, Europe is expected to grow at a notable rate in the future, owing to the advanced polymer technology usage in recent years.

- By type, the polyethylene segment led the market in 2024 with 25% market share, due to its various applications in sectors such as films, packaging, containers, and household products.

- By origin, the synthetic polymers segment emerged as the top-performing segment in the market in 2024 with 90% industry share, due to its unique characteristics, such as large-scale accessibility and cost-effectiveness.

- By processing technology, the injection moulding segment led the market in 2024 with 35% market share because it is the most common and cost-effective technique to produce complex polymer parts.

- By end-use industry, the FMCG segment led the polymers market in 2024 with 35% market share, due to the massive demand for packaging materials in food, beverages, cosmetics, and household goods.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5776

Polymers Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 839.78 Billion |

| Revenue forecast in 2034 | USD 1,351.59 Billion |

| Growth Rate | CAGR of 5.43% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2034 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type, By Origin, By Processing Technology, By End-Use Industry, By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country scope | U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia |

| Key companies profiled | Dow Inc., Evonik Industries AG, Eastman Chemical Company, Covestro AG, Mitsui Chemicals Inc., Exxon Mobil Corporation, Royal DSM, BASF SE, Clariant International Limited, Huntsman Corporation. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What are the Major Trends in the Polymers Market?

- Sustainable Polymers- Heightened environmental awareness has pushed demand for biodegradable and recyclable polymers. These materials, especially in consumer goods and packaging, are sought after by consumer goods and packaging companies who want to be more proactive or compliant with problematic plastics and environmental regulations.

- Bio-Based Polymers- Polymers from renewable materials (e.g. corn, sugar cane, cellulose) continue to see adoption across consumer goods, packaging, textiles and automotive sectors that support the transition to circular and sustainability-based manufacturing practices.

- Smart Polymers- Polymers that respond to changes in temperature, pH, and/or light have seen increasing use across facilities that develop medical devices, as a means of adaptive materials and drug delivery systems.

- Medical Polymers- Although the market for specialty medical polymers is small, there is growth in demand for healthcare-related applications (i.e. drug delivery, implant and drug carrier materials, medical packaging) that are driven by an aging population, advances in material science, and emerging innovations in biocompatibility.

-

Polymer Nanocomposites- The infusion of nanoparticles into polymers has proven to improve mechanical, thermal, and barrier properties of polymers delivering novel high-performance materials for automotive, electronics, construction and other industries, while enabling innovation and development of advanced materials.

Polymers Market Growth Factors

Driving Factor

Why is the Automotive Sector Driving Dramatic Polymer Demand?

The automotive industry is one of the major drivers of the polymer market, as manufacturers want lightweight, strong, and sustainable materials. Leading automotive manufacturers, including Volvo Cars, Mercedes-Benz, Renault, and Stellantis, along with tire manufacturers like Pirelli and Michelin, aim to use 30–40% reused, recycled, or renewable materials in vehicles by 2030. As a result, demand for new polymers required to develop sustainable, lighter vehicles is increasing.

In July 2024, LyondellBasell commercially launched Schulamid ET100, a polyamide-based compound, for automotive interior applications like door window frames. This new compound has a lower density than regular structural materials, and can provide lightweight construction and lower carbon emissions. It shows how important polymers are to the industry's shift to more sustainable and lighter mobility.

Opportunity Factor

Can advanced recycling be the next growth opportunity for the polymers market?

An important opportunity for the polymers market is the growing adoption of advanced recycling technologies that can produce high-quality, certified food-grade, and medical-grade recycled plastics. INEOS Olefins & Polymers Europe did begin production of advanced recycled polymer at its Lavera facility in Southern France in June of 2025. The company will be using pyrolysis oil to help its customers meet EU legislation requiring at least 10% recycled content in food contact, medical and sensitive plastic packaging by 2030.

This shift not only aids in the transition to a circular economy, but, it allows polymers to be viewed as leading enabler in both sustainable packaging, and healthcare applications, which opens up an important sustainable growth opportunity for players in the market.

Limitations and Challenges in the Polymers Market

- Environmental Issues- Rising plastic waste and ocean pollution indicate growing sustainability challenges for the polymer industry. Increased restrictions on single-use plastic and carbon emissions are forcing producers to shift to greener alternatives, causing a disruption in conventional polymer demand.

- Unsteady Raw Material Prices- Most polymers come from petrochemical sources, which mean the polymer industry is susceptible to volatile crude oil prices. Price fluctuations of raw feed stock may have an impact on manufacturing margins, stability of the supply, and long-term price development.

- Tight Regulatory Frameworks- Governments in all areas are tightening their rules on the use of polymers for packaging, automotive, and healthcare related applications. Constantly evolving safety, recycling, and biodegradable requirements have stretched operating costs and product commercialization timelines.

- Recycling and Waste Management Challenges- Despite implemented recycling initiatives, a large share of polymer material still ends in landfills. The success of these programs is hampered by limited recycling infrastructure, poor collection programs, and high processing costs which are contributing barriers to adopting the circular economy.

Why Did Asia Pacific Dominate the Polymers Market in 2024?

Asia Pacific is in front of the game due to the complementary nature of expansion in upstream feedstock, well established downstream manufacturing clusters and incentives to localize supply chains in the region. In the last 2 years, a large wave of new investments in refineries and crackers in China and surrounding Southeast Asian nations has driven ethylene and propylene supply as well as commodity and fast-growing specialty polymers production efficiencies. Domestic demand from packaging, construction, automotive, and electronics is being supplemented by new advanced recycling initiatives set to commercialize in the region.

China Polymers Market Trends:

China also continues to strengthen the industry with its historical strength linked to massive petrochemical and refining build-out (cracking and PDH units) to reduce feedstock costs and create unprecedented availability of monomer for domestic and export purposes. For instance in February 2025, Rianlon one of China's leading polymer additives companies plan to invest up to USD 300 million in Malaysia to develop R&D and production facilities. If successful, this further advances China's view of innovation-based polymer additives as a strategic, regional compatible capability that diversifies risk and builds resilience in the value chain, while also highlighting how companies move beyond commodity scale to develop higher valued, specialized, polymer technology across Asia.

Why Is Europe the Fastest-Growing Region in the Polymers Market?

Europe is becoming a fastest growing region in polymers market by closely aligning regulation and industrial development, for example, the specifics of the EU requirement for minimum recycled content in plastic packages by 2030 are shaping the structure of polyolefin competition, and the relevant chemical-recycling technologies to work on now have attracted significant capital investments, which will put feedstock streams into the marketplace with EU rules on traceability for packaging, automotive and medical applications too, and moved dramatically to greater demand for the highest-value sustainable polymer grades instead of conventional resins.

Germany is the main driver of the European polymer transition because it is where so many other global chemical majors are located, as well as some other advanced converters and OEMs needing sustainable materials. BASF, COVESTRO, and more, are scaling biomass-balance polymers and new partnerships with advanced recycling, while engineering companies are delivering turn-key systems to the chemical recycling project consortiums. German auto makers, packaging companies, and all the rest are putting procurement commitments beyond previous levels on low-carbon and recycled-content polymers as buyers need certainty of downstream demand, the government is creating policy, and they are investing in intensive R&D intensity and pressure from end-users.

Polymers Market Segmentation Insights

Type Insights

Which type is leading the Polymers Market?

The Polyethylene segment dominated the polymers market in 2024, due to its various applications in packaging, films, containers, and building products. It is versatile, inexpensive, and incredibly resistant to many chemicals, allowing for so many different applications across a multitude of industries. The growing interest in recyclable packaging and lightweight materials that are easier to transport will aid polyethylene's dominance in the market worldwide.

Polyethylene terephthalate is the fastest growing polymer type, with no end in sight based on its strong demand in the food and beverage market for bottles and containers. PET is transparent, lightweight, and recyclable and is perfect for eco-friendly packaging. Additionally, PET is gaining traction in textiles and engineers are starting to explore its use in electronic and automotive components which will usher in a rapid growth in the PET segment the next few years.

Origin Insights

Which Origin Segment is leading the market?

In 2024, the Synthetic polymers segment held the largest share of the polymers market, due to their low cost, widespread availability, and mass production nature. With the performance and durability of synthetic polymers, they have found application in packaging, automotive components, textiles and consumer goods, all at high volumes. Industries are moving towards utilizing synthetic variants as natural polymers can't guarantee consistency across geographic regions and are less adaptable for large volume use around the world.

Natural polymers are the fastest-growing origin segment in forecasted period, as an increasing number of businesses seek sustainable and biodegradable materials to develop and package products. Companies have started taking into consideration the environmental impact of plastic waste and stricter regulations are prompting industries to adopt alternatives like starch-based polymers, cellulose, and chitosan. The applications of natural polymers across medical, food packaging, and agriculture provide evidence of an impressive shift towards biodegradable materials.

Processing Technology Insights

Why did the Injection moulding Segment Dominate the Polymers Market?

The consumer electronics segment held the share of the polymers market in 2024, since it is the preferred method to manufacture complex components in large numbers. Injection molding is a very efficient and low-cost process due to its ability to mold any type of polymer for many applications including automotive parts, containers for consumer and household goods, electronic housings, packaging, etc. The ability to scale and the diversity of the process helps maintain its position of dominance across many industries.

The blow molding segment is expected to grow the fastest in the coming years as the growth of bottles, containers, and all types of hollow plastic products help drive the segment. Its suitability for producing lightweight and strong packaging solutions for food, beverage, and healthcare markets contributes to its growth. The growing emphasis on more recyclable formats also supports growth of blow molding in the global market.

End-Use Industry Insights

Which Industry is the most Dominant End User Segment in Polymers Market?

The FMCG industry segment remains dominant segment of polymers market in 2024, as it is centered on plastics for packaging, storage, and shipping. Polymers are used in food, beverage, and personal care packaging as it is important to protect the product and increase shelf life. There will always be demand for lightweight, cost-effective, and recyclable packaging materials, giving the FMCG sector a strong position on polymer consumption.

Medical device manufacturing is the fastest growing end-use industry segment driven by increased healthcare demand and advancements in medical technologies. Polymers are essential for producing surgical instruments, implants, drug delivery systems, and single-use medical products. Trends toward biocompatible and sterilizable polymer materials promote their use therefore making healthcare applications amongst the quickest growing and expanding areas in the market.

More Insights in Towards Chemical and Materials:

- Specialty Fertilizers Market : The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Fertilizers Market ; The global fertilizers market volume reached 193.20 million tons in 2024 and is projected to hit around 262.18 million tons by 2034, expanding at a CAGR of 3.10% during the forecast period from 2025 to 2034.

- Specialty Polymer Market : The global specialty polymer market volume was estimated at 17.71 million tons in 2024 and is predicted to increase from 19.25 million tons in 2025 to approximately 40.7 million tons by 2034, expanding at a CAGR of 8.67% from 2025 to 2034.

- Bio-Based Polymers Market : The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034.

- Medical Fluoropolymers Market : The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034.

- Lignin-based Biopolymers Market : The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Fluoropolymers Market : The global fluoropolymers market volume was valued at 639.21 kilo tons in 2024 and is expected to reach around 1351.23 kilo tons by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Bioresorbable Polymers Market: The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

- Polymer Chameleon Market : The global polymer chameleon market size was reached at USD 415.70 billion in 2024 and is expected to be worth around USD 1,122.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.44% over the forecast period 2025 to 2034.

- U.S. Fluoropolymer Coating Market : The U.S. fluoropolymer coating market volume was reached at 23,400.0 tons in 2024 and is expected to be worth around 39,970.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.50% over the forecast period 2025 to 2034.

- Polymer Denture Material Market : The global polymer denture material market size accounted for USD 2.49 billion in 2025 and is forecasted to hit around USD 4.11 billion by 2034, representing a CAGR of 5.75% from 2025 to 2034.

- Super Absorbent Polymer Market : The global super absorbent polymer market volume was accounted for 3.87 million tons in 2024 and is expected to be worth around 7.92 million tons by 2034, growing at a compound annual growth rate (CAGR) of 7.43% during the forecast period 2025 to 2034.

- Lignin-based Biopolymers Market : The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Fiber Reinforced Polymer Composites Market : The global fiber reinforced polymer composites market size was valued at USD 104.19 billion in 2024 and is estimated to hit around USD 196.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55% during the forecast period 2025 to 2034.

- Polymer Modified Bitumen Market : The global polymer modified bitumen market volume was valued at 25.70 million tons in 2024 and is expected to hit around 39.90 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.50% over the forecast period 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Bioresorbable Polymers Market : The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

Polymers Market Top Key Companies:

- Dow Inc.

- Evonik Industries AG

- Eastman Chemical Company

- Covestro AG

- Mitsui Chemicals Inc.

- Exxon Mobil Corporation

- Royal DSM

- BASF SE

- Clariant International Limited

- Huntsman Corporation

Recent Developments

-

In June 2025, Clariant presents AddWorks PPA, a polymer processing aids line that is PFAS-free, including AddWorks PPA 101 FG and 122 G, which also are fully compliant for food-contact use globally, recyclable, and commercially available globally.

Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polymers Market

By Type

- Thermoplastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (PA)

- Polymethyl Methacrylate (PMMA)

- Others (EVA, POM, etc.)

- Thermosetting Polymers

- Epoxy Resins

- Phenolic Resins

- Polyurethane (PU)

- Unsaturated Polyester Resins (UPR)

- Melamine Formaldehyde (MF)

- Urea Formaldehyde (UF)

- Elastomers

- Natural Rubber (NR)

- Synthetic Rubber (SBR, NBR, EPDM, etc.)

- Thermoplastic Elastomers (TPE)

By Origin

- Synthetic Polymers

- Natural Polymers (Cellulose, Starch, Proteins, etc.)

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Rotational Molding

- Others (Thermoforming, Calendering, etc.)

By End-Use Industry

- FMCG

- Automotive OEMs

- Construction Firms

- Electronics Manufacturers

- Medical Device Manufacturers

- Textile Manufacturers

- Agricultural Input Producers

- Industrial Equipment Manufacturers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5776

bout Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.